In today’s financial landscape, a Permanent Account Number (PAN) is indispensable. This unique identifier, issued by the Income Tax Department of India, is required for a wide range of financial activities, from filing taxes to opening bank accounts. But what happens if you misplace your PAN card or forget your PAN number? Don’t worry—this step-by-step guide for 2024 will help you find PAN number quickly and easily.

What is PAN and Why Is It Important?

PAN Defined

A Permanent Account Number (PAN) is a 10-digit alphanumeric code that serves as a unique identifier for individuals and entities in India. The PAN is linked to all your financial transactions, making it an essential document for anyone engaged in financial activities.

Importance of PAN

Your PAN is critical for:

- Filing Income Tax Returns: It’s mandatory for filing taxes and claiming refunds.

- Opening Bank Accounts: Banks require PAN for account opening, loans, and large transactions.

- Investments: PAN is needed for buying or selling securities like stocks, bonds, and mutual funds.

- Property Transactions: PAN is essential for buying or selling property.

- High-Value Purchases: Large financial transactions, such as purchasing a car, require a PAN.

How to Find PAN Number

If you’ve lost your PAN card or forgotten your PAN number, there are several methods to retrieve it.

1. Using the Income Tax E-Filing Website

One of the most reliable ways to find PAN number is through the Income Tax Department’s e-filing website.

First Step: Access the Income Tax E-Filing Website

Go to https://www.incometax.gov.in/iec/foportal.

Step 2: Sign In or Register

If you have an existing account, sign in with your login details. If not, you’ll need to register by providing your basic details like name, date of birth, and email ID.

Step 3: Go to PAN Details

After signing in, head to the ‘My Account’ section. Here, you’ll find an option labeled ‘PAN Details.’ Click on it to view your PAN number.

Step 4: Download or Print

You can either download the details or print them out for future reference.

2. Through Your Bank

If your PAN is connected to your bank account, you can obtain it by contacting your bank.

Step 1: Visit Your Bank Branch

Head to your bank and request assistance in retrieving your PAN number.

Step 2: Provide Identification Proof

You’ll need to provide valid identification, such as Aadhaar, Voter ID, or Passport, to verify your identity.

Step 3: Receive Your PAN Number

Once verified, the bank official will provide your PAN number. Some banks also offer this service via their customer service hotlines or internet banking portals.

3. Using Aadhaar Card

If you’ve linked your PAN with Aadhaar, you can retrieve your find PAN number easily through the Income Tax Department’s portal.

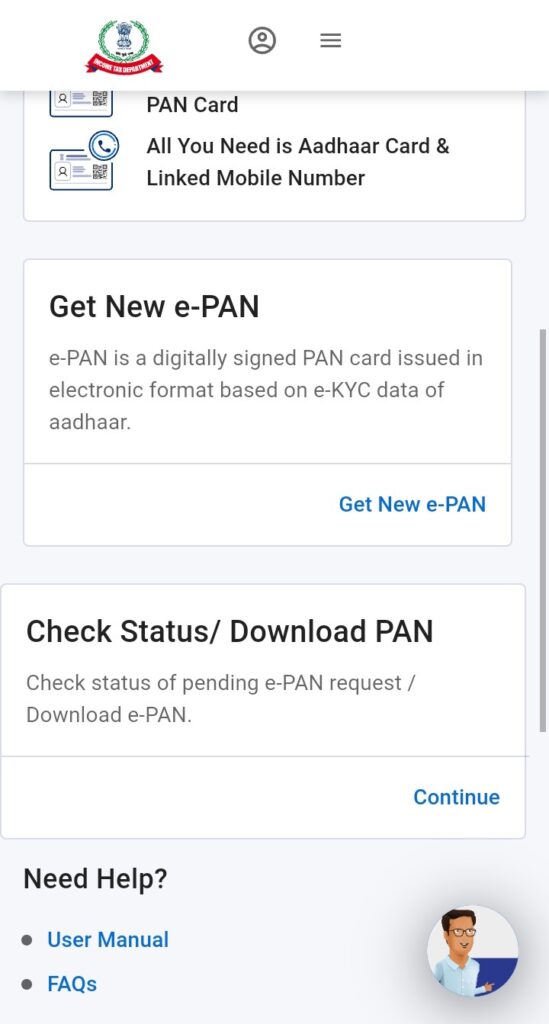

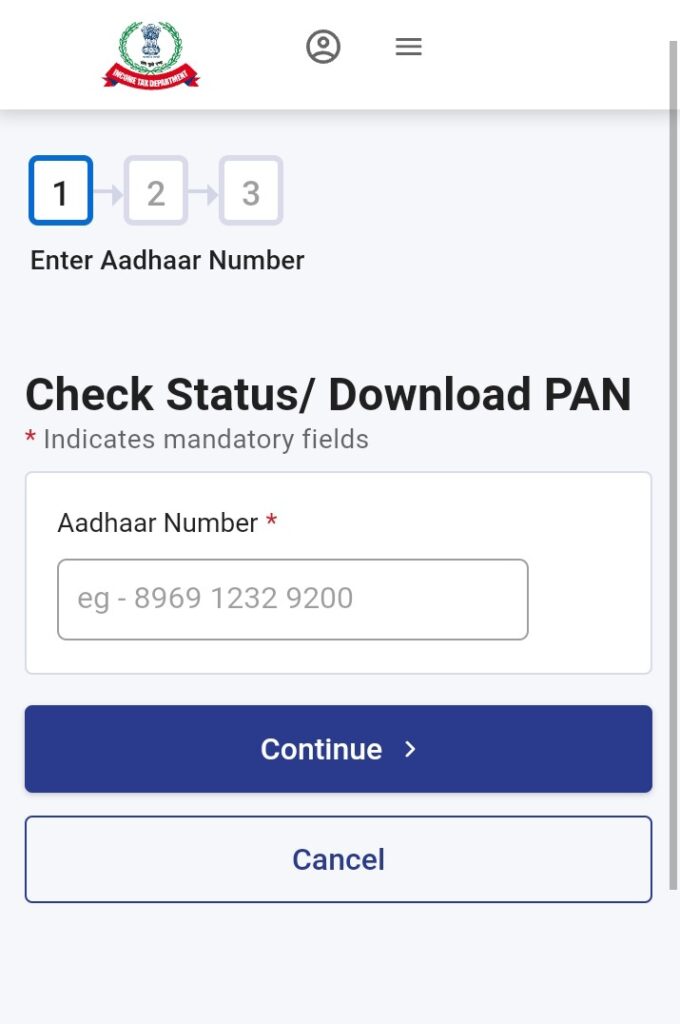

Step 1: Access the E-Filing Website

Go to https://www.incometax.gov.in/iec/foportal.

Step 2: Link Aadhaar to PAN

If not already linked, you’ll need to link your Aadhaar to your PAN via the ‘Link Aadhaar’ option.

Step 3: Retrieve Your PAN Number

Once linked, log in to the portal and check your PAN number under the ‘Profile Settings’ section.

4. Using the ‘Know Your PAN’ Service

The ‘Know Your PAN’ service is another simple method to find pan number.

Step 1: Visit the Income Tax Portal

Go to https://www.incometax.gov.in/iec/foportal.

Step 2: Select ‘Know Your PAN’

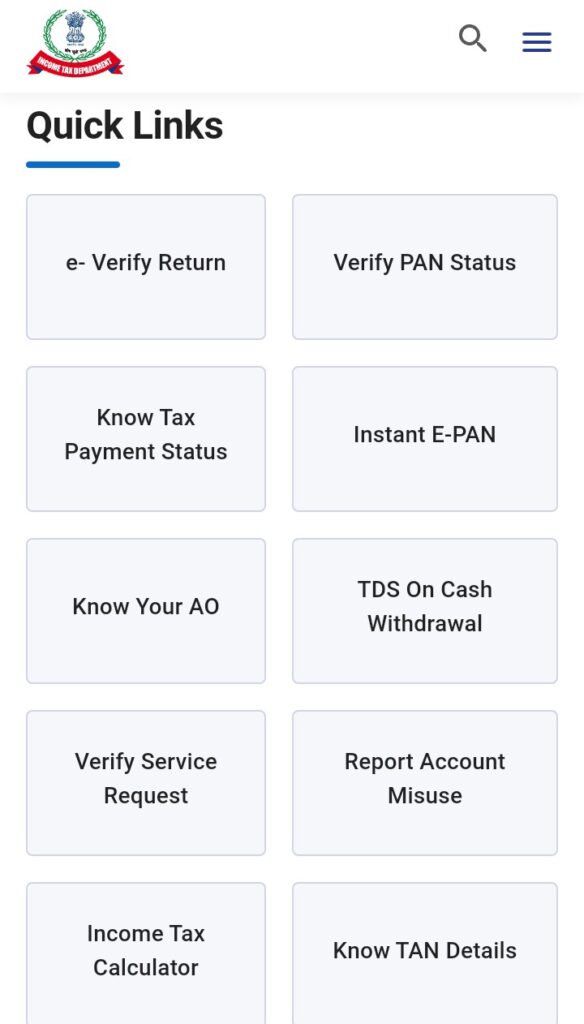

Find the ‘Quick Links’ section and click on ‘Know Your PAN.’

Step 3: Fill in Required Details

Provide your name, date of birth, and the mobile number registered with your account.

Step 4: Retrieve Your PAN Number

Submit the form, and your PAN number will be displayed on the screen. You can note it down or take a screenshot for safekeeping.

5. Through NSDL or UTIITSL Portals

You can also use the NSDL (National Securities Depository Limited) or UTIITSL (UTI Infrastructure Technology and Services Limited) portals to retrieve your PAN number.

Step 1: Visit the NSDL or UTIITSL Portal

Access these websites at https://www.tin-nsdl.com/ or https://www.utiitsl.com/UTIITSL_SITE/.

Step 2: Use the PAN/TAN Application

Locate the PAN/TAN application section on the website.

Step 3: Provide Necessary Details

Input your name, birthdate, and the mobile number linked to your account.

Step 4: Retrieve Your PAN Number

After submitting your details, your PAN number will be sent to your registered mobile number or email.

Things to Keep in Mind

- Keep Your PAN Details Safe

After obtaining your PAN number, keep it in a safe place. Consider saving it in a password-protected file or document. - Link PAN with Aadhaar

Linking your PAN with Aadhaar can make it easier to retrieve your PAN number in the future and helps with tax-related procedures. - Update Contact Information

Ensure that your contact details, such as your mobile number and email, are up to date with the Income Tax Department. This will help you receive all PAN-related communications. - Apply for a Duplicate PAN Card

If you’ve lost your PAN card, consider applying for a duplicate one through the NSDL or UTIITSL portals. This way, you’ll always have a physical copy of your PAN.

find pan number using aadhar number without OTP

rules:-

- Visit find pan number website.

- enter your adhar card number and click find pan number button

- Send aadhar card number and 100₹ and wait 2 minutes.

- give your pan card number.

Conclusion

Find PAN number in 2024 is straightforward, thanks to the digital services provided by the Income Tax Department and financial institutions. Whether you choose to retrieve it through the e-filing portal, your bank, or the Aadhaar linkage, this guide ensures you can easily find PAN number when needed.

Your PAN is an essential part of your financial identity, so make sure to keep it safe and secure. If you’ve lost or forgotten your PAN number, follow the steps outlined above to retrieve it quickly and continue with your financial activities without interruption. Stay prepared and keep your PAN details within reach to avoid any future hassles. Read more